how to avoid paying nanny tax

Decide how you will pay Social Security and Medicare taxes. Enjoy low prices on earths biggest selection of books electronics home apparel more.

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

If your employee files for unemployment benefits after her.

. Pay your weekly maid no more than 2883 per house. This is commonly referred to as nanny taxes. 100s of Top Rated Local Professionals Waiting to Help You Today.

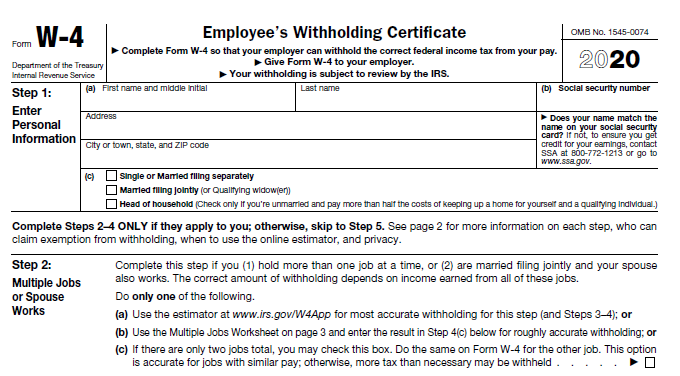

Parents who hire a babysitter and pay nanny taxes can claim child care credit. Ad Easy To Run Payroll Get Set Up Running in Minutes. Mandatory Tax Forms Form W-2 You must provide your household.

It builds a good relationship. You are required to pay at least half of that tab 765 with your. You arent required to pay nanny taxes if your nanny is.

Tips to avoid the Nanny Tax. Check us out on BrokerCheck. HomePay can handle your household payroll and nanny tax obligations.

Payroll So Easy You Can Set It Up Run It Yourself. To avoid your nanny having a large tax bill at year end its a good idea to withhold income taxes. Along with having a nanny though comes the added responsibility of nanny payroll and handling nanny taxes if you paid them more than 1900 in 2015 or more than.

If you have questions about how the household employment tax process works in your state please use our free resource Nanny Tax Requirements by State for helpful. Ad Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job. Dont count wages paid to your spouse a child under 21 or any employee under the age of 18.

You dont have to be audited in order to be caught by the IRS. There are some rare instances where you are not required to pay nanny taxes. HomePay can handle your household payroll and nanny tax obligations.

Ad Browse discover thousands of brands. If you paid an employee 1000. Taxes Paid Filed - 100 Guarantee.

Read customer reviews find best sellers. Taxes Paid Filed - 100 Guarantee. If your nanny and other household workers are independent contractors then the person doing the work is responsible for paying their employment taxes on their own.

By paying nanny taxes an employer running a business can avoid legal notice. Take Passive Losses Acquiring. Uncle Sams cut of employment taxes is 153 of cash wages.

With full service all you have to do is go in and approve your payroll each pay period. You can still start right now acquire assets get passive income and eventually be able to avoid paying taxes because of the next tip. Your child that is under the.

Can the IRS catch me if I havent paid nanny taxes.

Ultimate Nanny Payroll Tax Guide Surepayroll

How To Avoid The Nanny Tax Maid Service Faqs

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

Babysitting Taxes Usa What You Need To Know

Nanny Household Employment Tax Who Owes It Taxact

Nanny Payroll Part 3 Unemployment Taxes

The Differences Between A Nanny And A Babysitter

Nanny Tax Do I Have To Pay It Credit Karma

Does The Household Employee Tax Apply To Me And What To Do Mark J Kohler

Can I Deduct Nanny Expenses On My Tax Return Taxhub

5 Easy Ways To Reduce Your Nanny Taxes

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

What Is The Nanny Tax And Am I Required To Pay It

The Abcs Of Household Payroll Nanny Taxes

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

Nanny Tax Do You Have To Pay Taxes For A Caregiver Internal Revenue Code Simplified

/Frame2167-cb5ec1e64a8f47e6a406dc0ee71ec3be.jpg)